Below are the key measures introduced in Budget 2013 as outlined in the Daíl.

3:47: That concludes Public Expenditure Minister Brendan Howlin’s speech

3:46 RESPITE CARE GRANT To be cut by 325 euro to 1,375 a year.

BACK TO EDUCATION ALLOWANCE – The 300 euro cost to education allowance to be abolished. STUDENT GRANTS – Student grant income threshold to be increased by 3%

3:40: MOTOR TAX INCREASES – EXAMPLES

Band A1 up 10 euro to 170 euro

Band A2 up 20 euro to 180 euro

Band A3 up 30 euro to 190 euro

Band A4 up 40 euro to 200 euro

Band B1 up 45 euro to 270 euro

Band B2 up 55 euro to 280 euro

Band C up 60 euro to 390 euro

Band D up 89 euro to 570 euro

3:36: Prescription charges are being increased for medical card holders and the family threshold is also being increased:

3:31: POLITICIANS EXPENSES

Plan to end the unvouched expenses system.

Cut of 10% on expediture limits

50% cut in use of prepaid Oireachtas envelopes

10% cut to Party Leaders Allowance and an audit of its use by Independent members

Abolishing severance payment to Ministers

3:30:FEE PAYING SCHOOLS – Pupil teacher ratio in fee paying schools to increase by two points.

STUDENT REGISTRAYION FEES – Increase by 250 euro next year and again in 2014 and 2014

3:25: CHILD BENEFIT – Cut by 10 euro per month. JOBSEEKERS BENEFIT – Duration cut by three months

3:22: SOCIAL WELFARE – No cuts in weekly payments

JOBS – department of jobs budget to be above half a billion euro and an additional 139 million for Enterprise Ireland.

JOBS PLACEMENTS – Increase by 10,000 the number of placements across labour market activation schemes from department of social protection.

3:20: CROKE PARK AGREEMENT An additional one billion euro in the pay and pensions bill must be achieved

3:15 Minister Brenden Howlin takes to his feet..

And that concludes Minister Noonan’s speech in the Daíl

3:14: Dirt to increase to 33% from 30%

3:09: PETROL – NO increase in petrol or diesel – CARBON TAX – Extending carbon tax to solid fuels over next two years on phased basis – rate of 10 euro per tonne from may next and to 20 euro per tonne in May 2014.

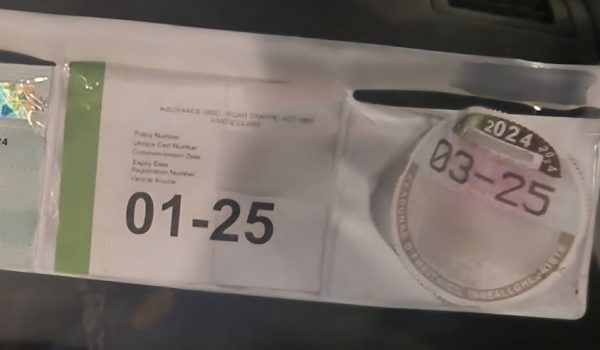

3:07: VRT AND MOTOR TAX – Increases across all catergories – DUAL CAR REGISTRATION From January Car Registration Plates to be 13 1 for first six months and 13 2 for second six months.

3:06: PINT – 10 cent on a pint of beer or cider from midnight tonight, 10 cent on a measure of spirits and ONE EURO on a bottle of wine.

CIGARETTES – 10 cent on a pack of 20 and 50 cent on a 25gramme pack of tobacco

3:03 : PROPERTY TAX: Local authorities to be given power to vary the rates by 15% above or below the national rates to better match funding needs.

Charge for 2013 will be a half year so on a home in the 150,000 to 200,000 band it will be 157 euro in 2013, 314 euro in 2014..

Deferral option for low income persons (gross income not exceeding 15,000) Other deferral options for those whose income less 80% of mortgage falls below 15,000 – Interest at 4% per annum will be charged

The household charge will cease from January 2013 – any arrears on July 1st next WILL BE INCREASED to 200 euro and WILL BE COLLECTED through local propert tax system.

SECOND HOMES CHARGE – This will CEASE from January 2014

2:56: PROPERTY TAX In effect from July 1 2013

– collected by revenue

– owners of residential properties, including rental properties will be responsible for payment

– payable on basisis of market value as assessed by owners with guidance from revenue or owners can use a competent valuer

– rate of 0.18% up to market value of 1 million euro and 0.25% on values above that and will be done AT THE MID POINT on bands of 50,000

– example a property between 150,001 and 200,000 will be valued at 0.18% of 175,000

– exemptions largely the same as those for household charge

2.54: PRSI abolishong the weekly allowance for workers and increasing the minimum level of annual contribution from the self-employed from 253 euro to 500 euro

2:48 BUDGET DEFICIT – Now estimate deficit will be 8.2% – well inside the 8.6% limit in the Troika agreement

PENSIONS From January 2014 tax relief on pension contributions will only be allowed on schemes that deliver up to 60,000 per annum – Tax relief will continue at the marginal rate of tax –

Pensions levy that was introduced to fund jobs initiative will not be renewed after 2014

Standard rate rather than reduced rats of USC will apply to pensioners over 70 with income of greater than 60,000 from January.

2.46: MORTGAGE INTEREST RELIEF Measure introduced last year will end on December 31st BUT exemption from new property tax up to 2016 for any new homes for first time buyers or unoccupied homes bought.

2.45: Relief from capital gains tax on disposal of farm land for restructuring purposes.

Extend tax relief scheme to 2020 and make Ireland more attractive for foreign film and TV productions.

Minister Confirms lower 9% VAT rate for Tourism industry to remain for 2013

2.41: Minister bringing forward 10 point tax plan for Small and Medium Enterprises

Includes: – Reform of Corporation Tax relief for startups – improve cash flow – and R and D tax credit.

Work ongoing on the PlusOne initiative which will encourage employers to help those long-term unemployed.

HAULAGE Introducing a rebate on diesel from July 1st next – to be fully policied to ensure tax compliance

2.37: Reform of the Three-Year Corporation Tax Relief for Start Up Companies to allow unused credit to carried forward..

2.31: Michael Noonan is about to deliver the budget.

2.05: The Taoiseach says the only alternative to the property tax in today’s budget is to increase income tax.

And Enda Kenny says that’s not the direction the Government wants to go in.

He’s blamed the Troika for the tax – but he says it will be progressive and fair:

1.35: Sinn Féin Finance spokesperson and TD for Donegal South West, Pearse Doherty, will be responding to the Minister for Finance’s Budget announcement at approximately 4.50pm today

1.30: Large numbers have gathered to demonstrate at Budget 2013 at the Market Square, Letterkenny and at Junior Minister Dinny McGinley’s office in Gweedore.

1.20: What to expect in Budget 2013 – A property tax, increases in motor tax, dearer cigarettes and a pint, higher tax on the interest on your savings and cuts in child benefit are all set to be announced in Budget 20-13.

At half two this afternoon Ministers Michael Noonan and Brendan Howlin will announce a 3.5 billion euro package of tax hikes and spending cuts.

Child benefit will be cut by 10 euro a month, while the back to school clothing allowance faces a cut from the current 150 euro to possibly 100 euro.

Medical card holders will see the price they have to pay for a prescription doubled to a euro.

Higher paid pensioners over seventy will pay a higher Universal Social Charge.

Pensioners will probably see their free telephone allowance halved to 155 euro a year.

Most employees will see themselves paying more PRSI – as much as 20 euro a month.

Smokers will see the price of a pack of twenty go up by 10 cent from midnight tonight – and drinkers will see at least five cent slapped on a pint.

Motor tax is going up – a 1.6 litre car will pay nearly 40 euro a year more – but it does appear as if petrol and diesel will be spared any rise.

Savers will see DIRT on interest go up to 33% from thirty, and of course the property tax will see someone with a home worth 200,000 pay about 350 euro a year.

12.50: Sinn Fein leader Gerry Adams says his party has warned the Government against being tilted towards the “golden circle” – and he says today’s budget will hit ordinary people the most:

12.45: The Sinn Fein deputy leader has criticised the Environment Minister for being away on a Government trip – while the Budget is being delivered at home.

Phil Hogan is in Qatar on a week long trip on UN climate change – and was photographed in today’s Daily Mail in a hotel bar in Doha.

12.30: The Finance Minister is preparing to deliver what’s being described as a “tough” and “unpopular” budget to the Dáil this afternoon.

At half past two, Michael Noonan is expected to outline 1.25 billion euro worth of revenue raising measures before the Minister for Public Expenditure and Reform Brendan Howlin gets to his feet to outline 2.25 billion euro worth of spending cuts.

The Finance Minister says there are also “loads of good things” in the Budget.

Speaking outside the Dáil this morning, Michael Noonan said this budget is about job creation and growing the economy:

- Fri, 18 Jul 2025

- (+353) 07491 25000

- (+353) 086 60 25000